In the fast-paced world of trading, the allure of automated systems has captivated both novices and seasoned investors alike. Imagine a scenario where your trading decisions are executed swiftly and accurately, day or night, while you focus on other ventures or enjoy well-deserved leisure time.

This guide is designed to take you through the exhilarating journey of setting up your first automated trading system—a task that may seem daunting at first, yet unfolds as an empowering experience. Whether you aim to leverage complex algorithms in the stock market or delve into cryptocurrency trading, understanding the essential components and processes is key.

From selecting the right platform and defining your trading strategy to monitoring performance and making adjustments, each step brings you closer to harnessing the power of technology in trading. Get ready to explore the dynamic intersections of finance and innovation, where your ambitions can translate into tangible results!

Introduction to Automated Trading Systems

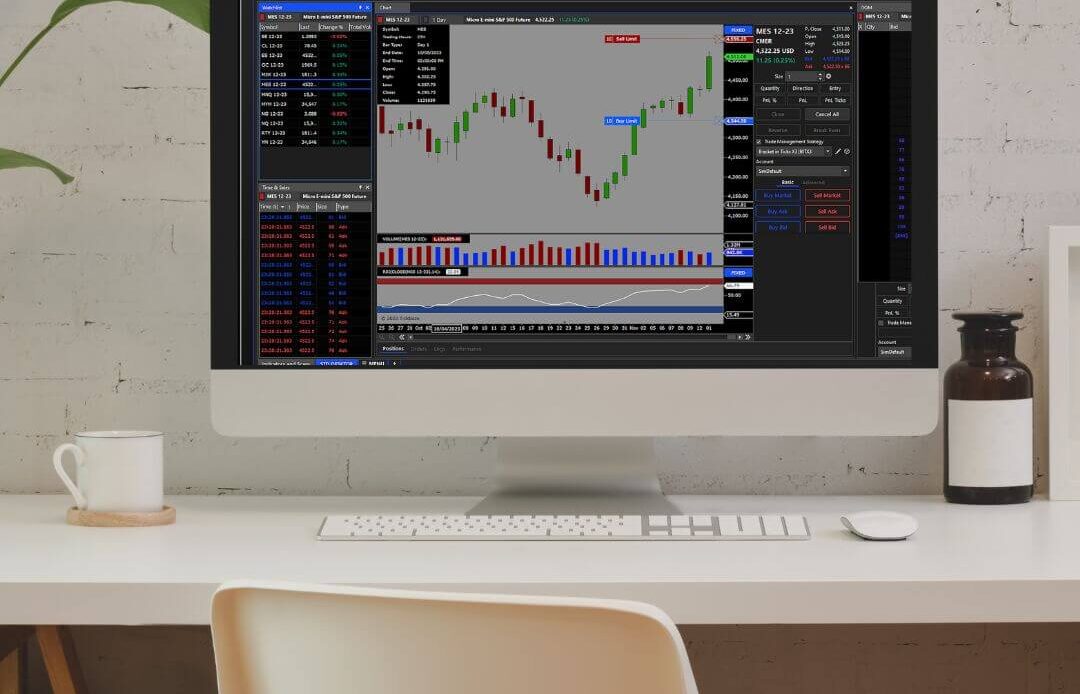

Automated trading systems represent a revolutionary shift in the realm of financial markets, merging technology with trading strategies to create a seamless investment experience. Imagine setting parameters with automated trading platform and letting algorithms execute trades on your behalf, tirelessly navigating through vast oceans of data that would overwhelm even the most seasoned traders. This system not only removes the emotional rollercoaster that often accompanies trading but also capitalizes on opportunities at lightning speed—something human traders can scarcely achieve.

As more individuals look to harness the power of automation, grasping the foundational concepts of these systems becomes imperative. Whether you\’re a beginner eager to dip your toes into the waters of algorithmic trading or an experienced trader poised to enhance your strategy, this guide will unravel the intricate tapestry of setting up your very first automated trading system, step by step.

Understanding Trading Algorithms

Understanding trading algorithms is essential for anyone venturing into the world of automated trading systems. At their core, these algorithms are sophisticated sets of rules and mathematical models that enable traders to execute orders at lightning speed based on predefined criteria.

Imagine a complex dance of data, where milliseconds can make or break an opportunity. Some algorithms analyze market trends in real-time, sifting through vast troves of information to identify patterns that the human eye might miss.

Others rely on predefined strategies, such as arbitrage or trend following, to capitalize on market inefficiencies. Yet, the true beauty of these systems lies in their adaptability; they can learn and evolve in response to changing market conditions.

As you embark on your journey to set up your first automated trading system, grasping the intricacies of trading algorithms will empower you to harness their full potential and navigate the financial markets with newfound confidence.

The Future of Automated Trading

The future of automated trading is poised at the intersection of cutting-edge technology and evolving financial markets, creating a landscape that promises both opportunities and challenges. Picture a realm where artificial intelligence evolves beyond mere execution of trades; it analyzes vast datasets in real-time, identifies emerging patterns, and adapts strategies with uncanny precision.

Meanwhile, the rise of decentralized finance (DeFi) is reshaping the very foundation of trading systems, offering unprecedented levels of transparency and accessibility. Imagine traders, both professional and novice, harnessing the power of sophisticated algorithms that learn and improve endlessly, making decisions based on predicted market movements rather than historical data alone.

Yet, this thrilling advancement is tempered by regulatory intricacies and ethical considerations, as markets grapple with the implications of automated systems acting without human oversight. As we forge ahead, the automated trading systems of tomorrow will not merely execute strategies—they will redefine how we think about trading itself, merging human intuition with machine efficiency in ways weve only begun to explore.

Conclusion

In conclusion, setting up your first automated trading system can seem daunting, but by following the step-by-step guide outlined above, you can navigate the process with confidence. From selecting the right automated trading platform to optimizing your algorithms, each step brings you closer to achieving your trading goals.

Remember that continuous monitoring and tweaking of your system are key to adapting to changing market conditions. With patience and practice, youll not only gain a deeper understanding of automated trading strategies but also enhance your potential for successful trades.

Embrace the journey, and let automation work for you in the dynamic world of trading.