Trading in the financial markets can feel like navigating a vast ocean, with opportunities and perils lurking beneath the surface. Many aspiring traders dive in headfirst, driven by the allure of quick profits, only to find themselves shipwrecked by costly mistakes.

However, there is a valuable lifeboat—a trading simulator—that can transform this tumultuous journey. By allowing traders to hone their skills in a risk-free environment, simulators offer insight and experience without the real-world consequences of a miscalculated decision.

Imagine being able to practice your strategies, test your instincts, and learn from your errors, all while avoiding the financial heartbreak that often accompanies live trading. As we unravel the many ways trading simulators can safeguard your investments and sharpen your acumen, you’ll discover that the journey to becoming a savvy trader can be both enlightening and enjoyable.

The Importance of Practice in Trading

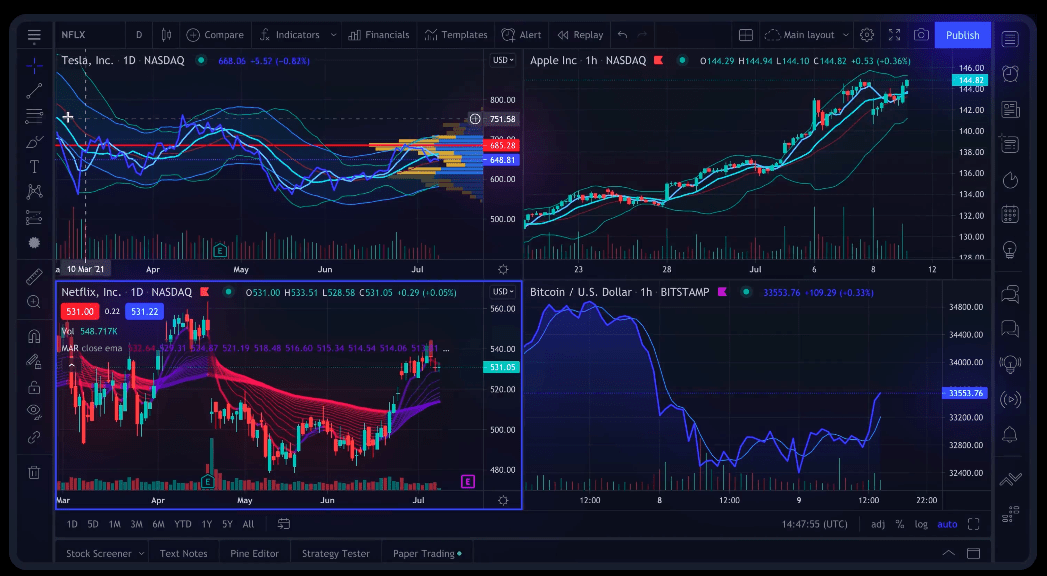

Practice is the bedrock of successful trading, underscoring the profound nuances of market behavior that theory alone cannot illuminate. Engaging with trading simulators, especially those equipped with a bar replay free tool, offers a unique platform to hone instinct, allowing traders to test strategies in real-time scenarios without the looming fear of financial loss.

It’s in these simulated environments that one can grapple with the emotional highs and lows of trading—from the euphoria of a well-placed trade to the sting of an unexpected downturn. As traders experiment with different tactics, they uncover patterns and learn to adapt, fostering an intuitive grasp of risk management that is crucial in actual markets.

Over time, this relentless practice not only sharpens skills but also cultivates discipline and confidence, essential qualities that can mean the difference between profit and misfortune.

Analyzing Trading Strategies Without Risk

When it comes to analyzing trading strategies without risking real capital, trading simulators offer an invaluable playground for both novices and seasoned traders alike. Imagine diving into a complex web of market scenarios where you can test your hypothesis about supply and demand without the pressure of financial loss looming over you.

Picture trying out different trading styles, from day trading to swing trading, each bringing its own unique rhythm and pattern. As you navigate these simulated environments, you encounter the unexpected—a market downturn that tests your economic theories, or an unexpected surge that forces you to rethink your approach.

This environment fosters a dynamic learning curve, allowing you to refine your strategies based on real-time feedback and market indicators, yet devoid of any dire consequences that come with actual trades. Ultimately, trading simulators serve as a crucible, where ideas can be tested, discarded, or perfected, empowering traders to emerge more competent and confident when they finally enter the live market.

Emotional Management and Discipline

Emotional management and discipline are the twin pillars that support successful trading, yet they can be elusive for many. A trading simulator offers a unique environment to cultivate these essential traits without the pressure of real money on the line.

Imagine vividly navigating through simulated market fluctuations, experiencing the thrill of rapid gains juxtaposed with the gut-wrenching urgency of sudden losses. Here, traders can practice not just the mechanics of buying and selling but also the art of maintaining composure under stress.

The ability to analyze one’s reactions, whether it’s the excitement of a win or the frustration of a loss, fosters a deeper understanding of personal triggers. By repeatedly confronting these emotional landscapes, traders can develop robust strategies to counteract impulsive decisions and build the discipline needed to stick to their trading plans—transforming potential pitfalls into stepping stones toward mastery.

Conclusion

In conclusion, trading simulators serve as an invaluable tool for both novice and experienced traders, enabling individuals to refine their skills, test strategies, and gain confidence without the risk of losing real money. By leveraging these platforms, traders can gain insights into market behavior and develop a deeper understanding of their trading style.

The inclusion of features like bar replay free feature adds an extra layer of realism, allowing users to practice trading scenarios at their own pace, thus reinforcing their decision-making capabilities under varying market conditions. Ultimately, the proactive use of trading simulators can significantly reduce the potential for costly mistakes, ensuring a more thoughtful and well-informed approach to trading in live markets.